As per the popular belief, only financial experts should possess the in-depth knowledge of the functioning of financial markets, and that general public need not to know much about stock markets. It’s been perceived that common people can take assistance of financial experts when the need arrives. At the end of the day, how much you need to know about stock markets and other investment instruments to make regular financial decisions, or while planning for your retirement? Besides, you do have all kind of financial tools at your disposal on the web to help you with all sort of tedious calculations.

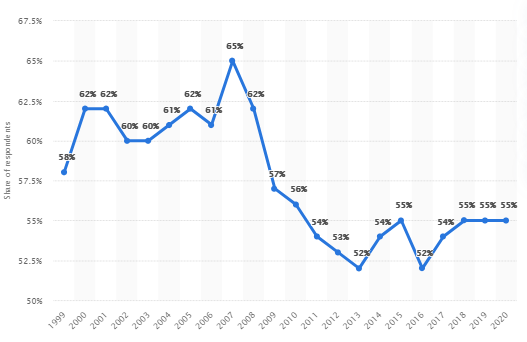

Share of Americans investing money in the stock market 1999-2020

Source: Statista

On top of everything else, you can always reach out to an investment advisor when the time comes to invest a large sum of money in the financial markets. That would take care of it. Correct? Or, the things are not as easy as they sound like, when it comes to investing in stock trading.

As per a Statista study, 55% of US adults in 2020 invested their hard-earned money in stock trading. The said percentage has kept constant in the last few years, but is much less than what it had to be before the period of Great Recession. In the year 2007, the percentage of investors saw its maximum, i.e. 65%.

In fact, the reason behind people investing less in the financial markets in the recent past is that more and more people these days are unaware of the basic financial concepts and money-management. This trend is a big cause of worry going forward, and it’s highly advisable to everyone, whether a financial expert or not, to go after acquiring fundamental knowledge about financial markets. And for banking aspirants, enroling into industry-relevant investment banking certifications is highly recommended.

Understanding of Finance is a Must: But, What Keeps Us Away From it?

Here are a couple of major factors that makes us wary of gaining financial education:

Brainwash by Mass Media

The overpowering presence of electronic media is a big reason for people getting swayed away when taking investment decisions. People do believe in what the mass media says and the experts that come over varied business news channels. The media help form opinions on companies listed on the stock exchange by feeding us the information they want us to believe in.

However, it’s a fact that a large chunk of the information showcased on TV news channels is promotional content, and is secretly sponsored. The media present the financial brands and products in a bright light when they have been sponsored, and the innocent public unaware of the nitty-gritties of financial markets absorb information at the face value. And that’s the primary reason to have your basics covered when it comes to familiarity with the functioning of trade markets.

Investment Decision-Making Must Not Need External Assistance

Seeking assistance from your friend, acquaintance, or relative brings in a lot of risk. Instead, if you try gaining knowledge on your own, and acquire the basic understanding of how the stock trading works, can prove to be highly beneficial in the long run. We are not saying that you should not seek advice from the professional investment banking advisors, but still, after receiving the advice from the expert, you need to put in your own mind to take the final investment decision.

The Extent of Financial Unawareness

It had been observed time and again that people, even in the most developed economies, are not adequately informed on the fundamentals of the functioning of financial markets. This has led to a surge in the number of cases wherein extreme load of debts had led to people going bankrupt. Private insolvencies have been on a constant rise since long with people possessing little to no knowledge regarding debt-management.

A majority of people all over the world consider gaining financial education to be an expert’s duty, and is necessary only for the professionals of the related domain. However, having a grasp on the basics of financial markets is vital to anyone and everyone.